CEA Industries has announced that it owns 480,000 BNB tokens, making it the biggest public BNB holder as the cryptocurrency reaches new record highs.

The company wants to buy 1% of all BNB tokens by the end of 2025. This shows that they have a strong plan to become the biggest institutional owner of Binance’s main token.

The company announced that it costs them an average of $860 to buy each BNB token, which adds up to about $412. 8 million spent overall.

On October 6, the total value of the holdings was $585. 5 Along with its cryptocurrency holdings, CEA reported having $77. 5 million in cash and similar assets. This means its total amount of cryptocurrency and cash is $663 million.

CEA Industries Becomes Part of Big Crypto Treasury Group

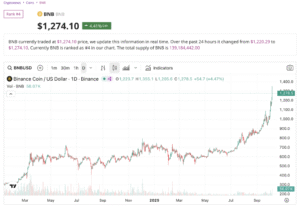

The news comes during a time when BNB is doing really well, reaching its highest price ever at $1,236. 74 on October 6. This increase has made its total market value go over $170 billion.

That valuation put BNB just after XRP and Tether, and about 33% more than Solana’s $127 billion market value.

Source: Yacryptocoin

This achievement also strengthens CEA’s position as one of the top digital asset treasury firms, placing it alongside companies like Strategy, which has a lot of Bitcoin, and Bitmine Immersion Technologies, which has the biggest Ethereum holdings.

CEO David Namdar of CEA said that BNB’s great performance shows that the asset has strong potential for the future.

“BNB’s highest prices show that people around the world are starting to recognize its real worth, trustworthiness, size, and usefulness, as well as the system it belongs to,” Namdar said. “We see BNB not just as a token but as a central part of a large and connected system. ”

Namdar, one of the founders of Galaxy Digital and a senior partner at 10X Capital, has been in charge of changing CEA into a company that manages cryptocurrency funds over the last year. The company, which used to make vapes in Canada, changed its name and started focusing on buying digital assets after raising money several times in the middle of 2025.

In June, the company’s stock price jumped almost 550% in one day after it said it would become the biggest BNB treasury company in the U. S

CEA raised $500 million by selling shares to investors, with support from 10X Capital and YZi Labs, a company linked to Binance co-founder Changpeng Zhao.

Because of that agreement and some extra options they used, the company could get up to $1. 25 billion to buy more BNB.

Namdar said that the company wanted to set up a U. S investment option called a “BNB treasury vehicle” to give regular investors clear access to the BNB Chain system.

BNB Rises to Become the Third Biggest Cryptocurrency by Market Value as Companies Increase Their Holdings

After getting more money, CEA started to increase its investments by buying more in the market and making special deals.

Since then, it has become the biggest company owner of BNB, going ahead of earlier companies like Nano Labs from Hong Kong, which revealed a $50 million purchase of BNB in July, and Windtree Therapeutics from the U. S, which said it would use most of its $520 million funding to buy BNB.

The time when CEA collected BNB matches a larger trend of institutions showing interest in BNB. In August, B Strategy started a $1 billion fund focused on BNB, supported by YZi Labs and family offices in Asia connected to the founder of Binance.

A few other companies listed on Nasdaq have also announced plans to create their own money reserves in BNB, as the token becomes popular with traditional investors.

BNB’s rise is due to more people using its ecosystem, large investments from institutions, and a strong overall crypto market. On October 6, BNB went above $1,300 for the first time, passing XRP to become the third-biggest cryptocurrency in the world by market value.

The 19% increase in value over the week raised its total market size to more than $154 billion, making it third after Bitcoin and Ethereum. The increase happened after Bitcoin went up to $126,000 because investors started looking at cryptocurrency during a situation in the U. S Government shutdown means the government temporarily stops working, and looking at digital assets as a way to protect against financial loss.

BNB Chain has experienced a lot of activity. The network now handles over 2. 44 million active addresses every day and $4. 14 billion in trading through decentralized exchanges, according to DeFiLlama.

Source: DeFiLlamaYacryptocoin

The total money in DeFi programs is $9. 27 billion, which is a 2. 5% increase in the last 24 hours. The network is making more than $4. 4 million in fees each day.

About 30% of BNB that is available is currently being staked. Recently, validators suggested reducing gas fees by 50% and making block times faster to compete better with Solana and Base.

BNB’s growth has also been recognized and accepted by big companies in other countries.

In late September, Kazakhstan said it would add BNB as the first asset in its Alem Crypto Fund national reserve.

The decision, along with growing company funds like CEA’s, has boosted confidence in BNB’s future in the global digital market.