Brazil has become the clear leader in cryptocurrency in Latin America. This is due to its practical approach to finance, clear rules about regulations, and the quick growth of stablecoins as useful money tools.

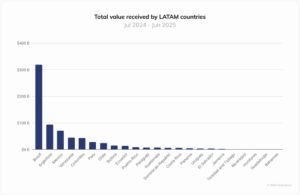

A report from Chainalysis says that from July 2024 to June 2025, Brazilian users received about $318. 8 billion in digital assets. This is almost one-third of all crypto transactions in Latin America.

In the area, total crypto transactions added up to almost $1. 5 trillion during that time. Monthly trading increased from $20. 8 billion in the middle of 2022 to a high of $87. 7 billion in December 2024.

Brazil Takes One-Third of Latin America’s $1. 5 Trillion Crypto Market — Stablecoins Are in the Lead

Brazil is strong because it uses stablecoins a lot. Experts believe that more than 90% of the country’s crypto transactions use stablecoins like USDT and USDC. These are used for sending money, paying for goods, employee salaries, and settling payments between countries.

Source: Chainalysis

In a country where prices change a lot and money can be unstable, stablecoins have become important. They provide consistency and easy access to cash that regular money often doesn’t.

According to Chainalysis, transactions by institutions have more than doubled compared to last year, while trading by individual investors is still strong. Big banks and financial companies like Itaú Unibanco, Mercado Pago, and Nubank are now adding cryptocurrency to their services, helping to connect regular money with digital money.

Local exchanges like Mercado Bitcoin, Foxbit, and BitPreço have helped Brazil by making it safer and easier to access cryptocurrency markets while working well with local banks.

Brazil has $318. 8 billion in cryptocurrency activity, which is much more than any other country in Latin America. Argentina came in next with $93. 9 billion due to high inflation. Mexico had $71. 2 billion, Venezuela had $44. 6 billion, and Colombia had $44. 2 billion, making up the top five.

Smaller but quickly growing markets like Peru ($28 billion) and Chile ($23. 8 billion) are being supported more and more by money sent home from abroad and new ideas in decentralized finance (DeFi).

Even though El Salvador is known for making Bitcoin legal money, it only had $3. 5 billion in activity. This shows that big policy changes don’t always lead to people using it more.

In Latin America, 64% of cryptocurrency trading happens on centralized exchanges (CEXs), which is more than in North America or Europe. This choice shows what happens in different areas, where CEXs make it easy to buy crypto, change money between currencies, and send money across borders.

Platforms like Bitso in Mexico and Colombia and Ripio in Argentina have made their services fit better with local payment systems. This helps users feel more secure and makes it easier for them to use the services.

Brazil is increasing its control over cryptocurrencies. The Central Bank of Brazil is looking at rules for foreign exchange and has a Bitcoin reserve worth $19 billion

Brazil is speeding up its rules for cryptocurrency as officials work on better managing virtual money and foreign exchange. The Virtual Assets Law (BVAL) of 2022–2023 is the main rule for cryptocurrency in Brazil. It gives the Banco Central do Brasil (BCB) the job of overseeing it and sets rules to prevent money laundering and ensure that businesses know their customers. This way, it helps support new ideas while keeping consumers safe.

After the BVAL, the government started more discussions about rules—Nos. 109, 110, and 111/2024—to focus on new topics like DeFi protocols, custodians, and stablecoin makers.

These new rules, expected by the end of 2025, aim to make things clearer and help Brazil be a leader in digital finance.

Brazil is moving forward with a big plan to set up a $19 billion Bitcoin reserve called RESBit, through a new law called Bill 4501/24. During a meeting on August 20, members of the Economic Development Commission of the Chamber of Deputies discussed a plan to include Bitcoin in Brazil’s money management strategy.

If it gets the go-ahead, the country will join places like El Salvador, the United States, China, and the European Union in officially adding digital money into their economies.

At the same time, the BCB is trying to increase its control over the foreign exchange (Forex) market, which might have an impact on crypto exchanges. A report says that the central bank shared a document asking for public feedback on stricter rules for overseeing electronic Forex (eFX) platforms.

The proposals don’t directly talk about crypto exchanges, but they would probably affect platforms that help with international money transfers or changing cryptocurrencies to regular money in currencies besides the Brazilian real.